The AP Economics Foreign Exchange Market delves into the captivating world of international currency trading, exploring its complexities, key players, and profound impact on global economics. As we embark on this journey, we will unravel the intricacies of this dynamic market, examining its structure, trading mechanisms, and the art of risk management.

Within the vast landscape of the forex market, we will encounter a diverse cast of participants, from multinational corporations to individual traders, each pursuing their unique strategies. Central banks, with their monetary policies, emerge as influential forces shaping exchange rate fluctuations, while technological advancements continue to reshape the trading landscape.

Foreign Exchange Market Overview

The foreign exchange market, also known as forex or FX, is a global decentralized marketplace where currencies are traded. It plays a crucial role in facilitating international trade and investment by enabling the exchange of one currency for another.

Currencies Traded

The forex market trades a wide range of currencies, including major currencies like the US dollar (USD), euro (EUR), Japanese yen (JPY), and British pound (GBP), as well as minor currencies and emerging market currencies.

Factors Influencing Exchange Rates

Exchange rates between currencies are influenced by various factors, including:

- Economic growth and stability

- Interest rates

- Inflation

- Political events

- Supply and demand

Key Players in the Foreign Exchange Market

The foreign exchange market is a global decentralized market where currencies are traded. It is the largest financial market in the world, with an estimated daily trading volume of over $6 trillion. The key players in the forex market include banks, corporations, and individual traders.

Banks are the largest participants in the forex market, accounting for about 50% of all trades. They provide liquidity to the market by buying and selling currencies on behalf of their clients. Banks also speculate on exchange rates, hoping to profit from movements in the market.

Corporations are another major participant in the forex market. They buy and sell currencies to facilitate their international trade and investment activities. For example, a U.S. company that imports goods from China will need to buy Chinese yuan to pay for those goods.

Individual traders are the smallest participants in the forex market, but they can still have a significant impact on exchange rates. Individual traders typically trade currencies for speculative purposes, hoping to profit from short-term movements in the market.

Central Banks

Central banks are government agencies that are responsible for managing the monetary policy of their respective countries. Central banks can influence exchange rates by buying and selling currencies in the forex market. For example, if the U.S. Federal Reserve wants to strengthen the U.S. dollar, it can buy U.S. dollars in the forex market, which will increase demand for the dollar and push up its price.

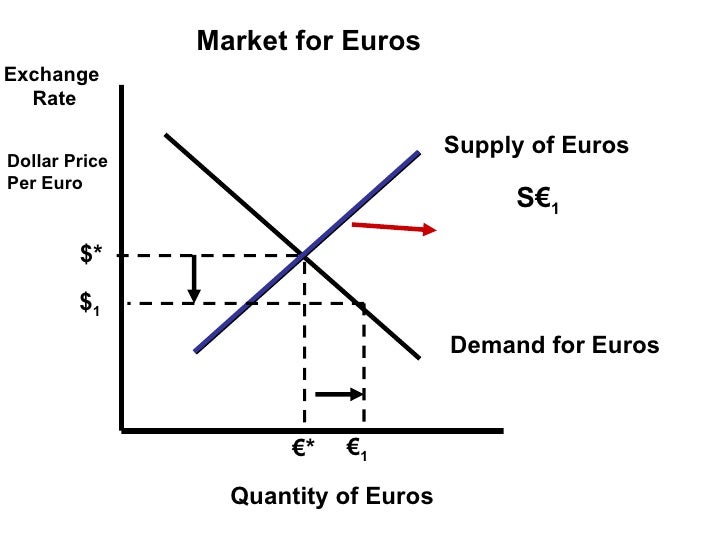

Obtain access to foreign exchange market supply and demand graph to private resources that are additional.

Economic Impact of Foreign Exchange Market

The foreign exchange market plays a pivotal role in shaping the global economic landscape. Its intricate network of currency transactions influences international trade, investment, economic growth, and inflation.

Impact on International Trade

Fluctuations in exchange rates can significantly impact the competitiveness of a country’s exports and imports. A stronger currency makes exports more expensive and imports cheaper, potentially reducing exports and increasing imports. Conversely, a weaker currency has the opposite effect, boosting exports and curbing imports.

Impact on Investment

The foreign exchange market influences the flow of foreign direct investment (FDI). Investors seek to invest in countries with stable and appreciating currencies, as they can potentially earn higher returns. Conversely, countries with depreciating currencies may experience a decline in FDI, as investors become hesitant to invest in assets that may lose value.

Impact on Economic Growth, Ap economics foreign exchange market

Exchange rate fluctuations can affect a country’s economic growth. A strong currency can boost exports and attract FDI, leading to higher economic growth. Conversely, a weak currency can hamper exports, discourage FDI, and increase the cost of imports, potentially slowing down economic growth.

Impact on Inflation

The foreign exchange market can influence inflation rates. A weaker currency can lead to higher import prices, which can translate into higher consumer prices and inflation. Conversely, a stronger currency can reduce import prices, potentially mitigating inflationary pressures.

Examples of Countries Impacted by Currency Movements

Several countries have experienced significant economic effects due to currency movements. For instance, the Japanese yen’s appreciation in the 1980s boosted exports and FDI, contributing to Japan’s economic boom. In contrast, the Thai baht’s devaluation during the 1997 Asian financial crisis led to a sharp decline in exports, FDI, and economic growth.

Market Structure and Trading Mechanisms

The foreign exchange market is the world’s largest financial market, with an estimated daily trading volume of over $5 trillion. It is a decentralized market, meaning that there is no central exchange where all trades are executed. Instead, trades are conducted over a network of banks, brokers, and other financial institutions.

The forex market is divided into three main types of markets: spot, forward, and futures.

Spot Market

The spot market is where currencies are traded for immediate delivery. Trades in the spot market are typically settled within two business days.

Forward Market

The forward market is where currencies are traded for delivery at a future date. Forward contracts are typically used to hedge against currency risk.

Futures Market

The futures market is where standardized currency contracts are traded on a futures exchange. Futures contracts are similar to forward contracts, but they are traded on an exchange and are subject to exchange rules and regulations.

Find out further about the benefits of foreign exchange market returns that can provide significant benefits.

Trading Platforms

There are a variety of trading platforms available to forex traders. These platforms allow traders to access the market, place orders, and monitor their positions.

- Retail platforms are designed for individual traders. These platforms typically offer a range of features, including charting tools, technical analysis, and news feeds.

- Institutional platforms are designed for large financial institutions. These platforms typically offer more advanced features, such as direct market access and algorithmic trading.

- Electronic communication networks (ECNs) are platforms that match buy and sell orders from multiple participants. ECNs typically offer lower spreads than traditional brokers.

Role of Technology

Technology has played a major role in the development of the forex market. The advent of electronic trading platforms has made it easier for traders to access the market and execute trades.

Further details about foreign exchange market participants who buys or sells foreign stocks and bonds is accessible to provide you additional insights.

Technology has also led to the development of new trading strategies. For example, algorithmic trading uses computers to automatically execute trades based on pre-defined criteria.

Risk Management in Foreign Exchange Trading

Risk management is crucial in foreign exchange trading, as it involves significant risks such as currency risk, interest rate risk, and liquidity risk. Understanding these risks and implementing effective strategies to manage them is essential for successful forex trading.

Currency Risk

- Currency risk arises from fluctuations in exchange rates between currencies.

- Traders can mitigate this risk by diversifying their portfolio across different currencies, hedging their positions using forward contracts or options, or employing stop-loss orders.

Interest Rate Risk

- Interest rate risk stems from changes in interest rates, which can affect the value of currency pairs.

- Traders can manage this risk by monitoring interest rate announcements, adjusting their trading strategies based on interest rate expectations, and using interest rate swaps or futures to lock in rates.

Liquidity Risk

- Liquidity risk occurs when there is a lack of buyers or sellers for a currency pair, making it difficult to execute trades.

- Traders can mitigate this risk by choosing highly liquid currency pairs, trading during peak market hours, and using limit orders instead of market orders.

Market Analysis and Forecasting: Ap Economics Foreign Exchange Market

Market analysis and forecasting are crucial aspects of successful foreign exchange trading. Traders employ various techniques to identify market trends and predict future exchange rate movements.

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends. It assumes that past price movements can provide insights into future price behavior. Common technical analysis tools include trendlines, moving averages, and chart patterns.

Fundamental Analysis

Fundamental analysis focuses on economic and political factors that influence exchange rates. It considers factors such as economic growth, inflation, interest rates, and political stability. By understanding the underlying fundamentals of a currency, traders can make informed decisions about its future value.

Economic Data and Political Events

Economic data and political events play a significant role in forecasting exchange rates. Important economic data releases, such as GDP growth, unemployment rates, and inflation figures, can have a significant impact on currency values. Political events, such as elections or geopolitical crises, can also cause volatility in the forex market.

Successful Market Analysis Techniques

Successful market analysis techniques often combine both technical and fundamental analysis. By considering both historical price data and underlying economic factors, traders can gain a comprehensive understanding of the market and make informed trading decisions. Some common successful market analysis techniques include:

– Trend following: Identifying and trading with the prevailing market trend.

– Support and resistance levels: Identifying areas where prices have historically found support or resistance.

– Moving averages: Using historical price data to create a smoothed average that helps identify trends.

– Economic indicators: Monitoring key economic indicators to gauge the health of an economy and its currency.

Summary

In conclusion, the AP Economics Foreign Exchange Market provides a comprehensive understanding of this vital aspect of international finance. By grasping the interplay between currencies, economic factors, and trading strategies, we gain invaluable insights into the forces that drive global commerce and shape economic destinies.