Suppose the foreign exchange market is in equilibrium. Which of the following statements are correct? This question delves into the intricate world of currency exchange, where supply and demand forces dance to determine the equilibrium exchange rate. Join us as we explore the factors that shape this dynamic market and unravel the complexities of its fluctuations.

The foreign exchange market, a global marketplace where currencies are traded, plays a pivotal role in international commerce. Understanding its equilibrium state is crucial for businesses, investors, and policymakers alike. This article will shed light on the concept of equilibrium in the foreign exchange market and examine the validity of various statements related to it.

Definition of Foreign Exchange Market Equilibrium

Equilibrium in the foreign exchange market is a state in which the demand for and supply of a currency are equal. At this point, there is no tendency for the exchange rate to change.

The equilibrium exchange rate is determined by a number of factors, including:

- Interest rates

- Inflation rates

- Economic growth

- Political stability

- Fiscal policy

- Monetary policy

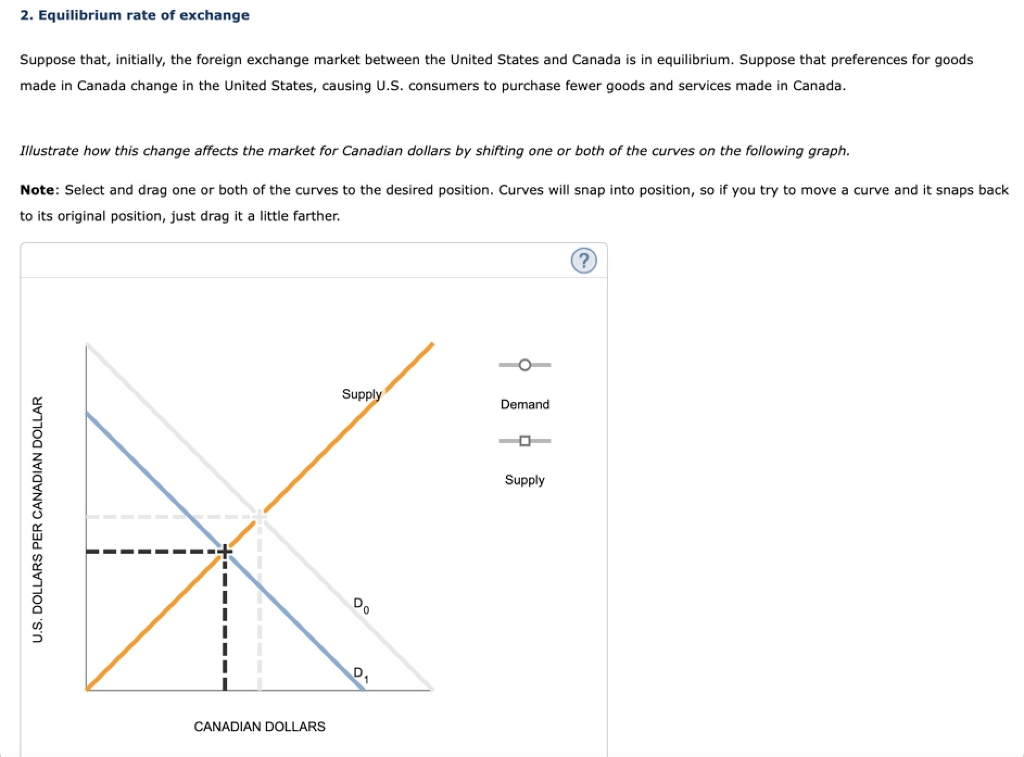

Impact of Changes in Supply and Demand

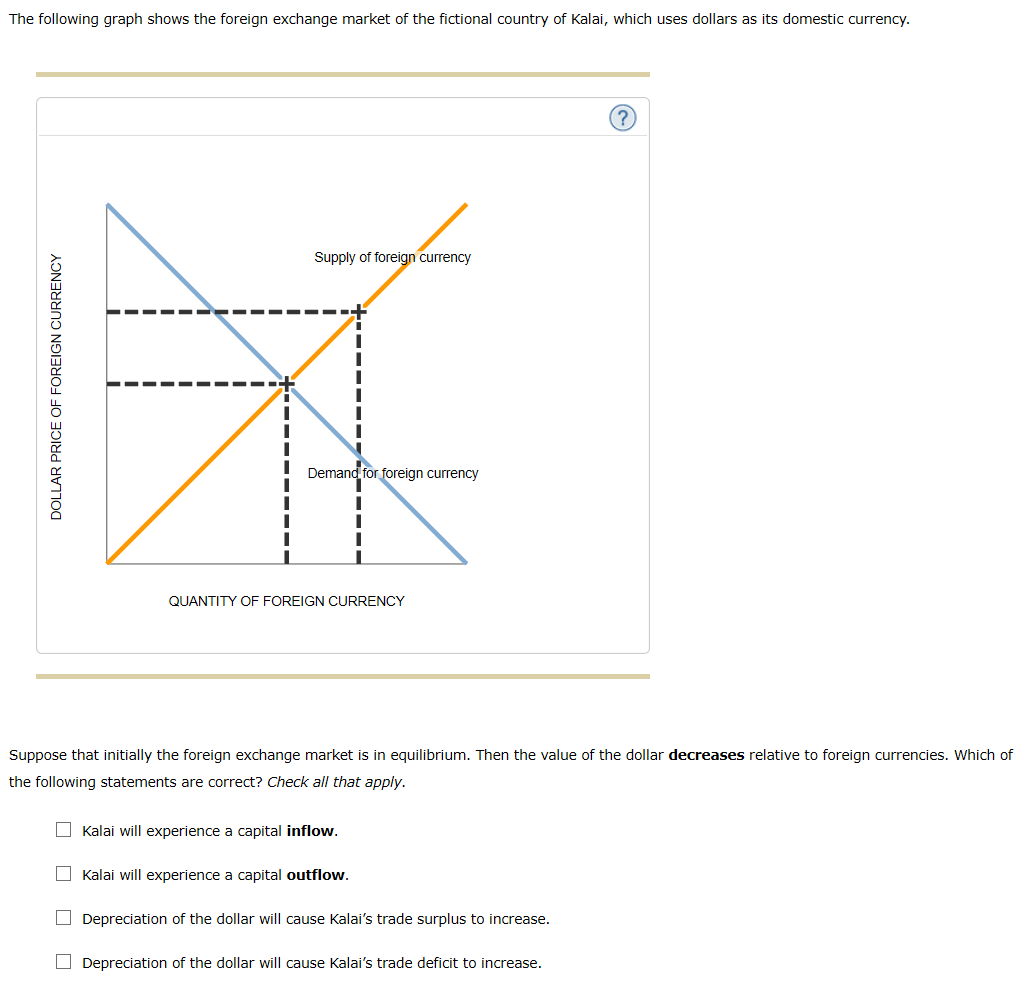

Changes in supply and demand in the foreign exchange market can significantly impact the equilibrium exchange rate. An increase in demand for a currency will lead to an appreciation in its value, while an increase in supply will lead to a depreciation.

For descriptions on additional topics like foreign exchange market value, please visit the available foreign exchange market value.

Here are some examples of how changes in supply and demand can affect the equilibrium exchange rate:

- An increase in demand for a currency can be caused by factors such as economic growth, political stability, or expectations of future appreciation. This will lead to an increase in the value of the currency against other currencies.

- An increase in supply of a currency can be caused by factors such as a trade surplus, foreign investment, or government intervention. This will lead to a decrease in the value of the currency against other currencies.

The following table illustrates the impact of different scenarios on the equilibrium exchange rate:

| Scenario | Impact on Demand | Impact on Supply | Impact on Equilibrium Exchange Rate |

|---|---|---|---|

| Economic growth in country A | Increase | – | Appreciation of currency A |

| Political instability in country B | Decrease | – | Depreciation of currency B |

| Trade surplus in country C | – | Increase | Depreciation of currency C |

| Foreign investment in country D | – | Increase | Depreciation of currency D |

Role of Central Banks

Central banks play a crucial role in maintaining foreign exchange market equilibrium. They act as the monetary authorities responsible for managing the supply and demand of currencies, thereby influencing exchange rates. Central banks utilize various tools and policies to achieve their objectives, such as:

Intervention in the Foreign Exchange Market, Suppose the foreign exchange market is in equilibrium. which of the following statements are correct

Central banks can intervene directly in the foreign exchange market by buying or selling currencies to influence their exchange rates. By increasing the supply of a particular currency, they can depreciate its value, while reducing the supply can lead to its appreciation.

Open Market Operations

Central banks conduct open market operations by buying or selling government securities in the open market. By purchasing securities, they inject money into the economy, increasing the demand for the domestic currency and leading to its appreciation. Conversely, selling securities withdraws money from the economy, decreasing the demand for the domestic currency and causing its depreciation.

Interest Rate Policy

Central banks set interest rates, which impact the attractiveness of a country’s currency for investment. Higher interest rates tend to attract foreign capital, increasing the demand for the domestic currency and leading to its appreciation. Lower interest rates, on the other hand, can discourage foreign investment and lead to currency depreciation.

Exchange Rate Fluctuations

Exchange rate fluctuations refer to the changes in the value of one currency relative to another. These fluctuations can be caused by a variety of factors, including economic, political, and social events.

Discover how foreign exchange market pdf notes has transformed methods in RELATED FIELD.

Exchange rate fluctuations can have a significant impact on businesses and individuals. For businesses, exchange rate fluctuations can affect the cost of importing and exporting goods and services. For individuals, exchange rate fluctuations can affect the cost of travel and the value of investments.

Understand how the union of foreign exchange market hours revolut can improve efficiency and productivity.

Causes of Exchange Rate Fluctuations

There are a number of factors that can cause exchange rate fluctuations. These include:

- Economic factors: Economic factors that can affect exchange rates include inflation, interest rates, and economic growth.

- Political factors: Political factors that can affect exchange rates include elections, wars, and changes in government policy.

- Social factors: Social factors that can affect exchange rates include changes in consumer preferences and demographic trends.

Impact of Exchange Rate Fluctuations on Businesses and Individuals

Exchange rate fluctuations can have a significant impact on businesses and individuals. For businesses, exchange rate fluctuations can affect the cost of importing and exporting goods and services. For individuals, exchange rate fluctuations can affect the cost of travel and the value of investments.

- Businesses: Exchange rate fluctuations can affect businesses in a number of ways. For example, a strengthening currency can make it more expensive for businesses to import goods and services. Conversely, a weakening currency can make it cheaper for businesses to import goods and services.

- Individuals: Exchange rate fluctuations can also affect individuals. For example, a strengthening currency can make it more expensive for individuals to travel to other countries. Conversely, a weakening currency can make it cheaper for individuals to travel to other countries.

Relationship to Other Markets

The foreign exchange market is closely intertwined with other financial markets, primarily the stock market and bond market. Interdependencies exist, and events in one market can have significant implications for the others.

Stock Market

The stock market reflects the value of companies and their underlying assets. A strong stock market, with rising stock prices, often indicates a positive economic outlook. This can lead to increased demand for the country’s currency, as investors seek to take advantage of the perceived economic growth. Conversely, a weak stock market, with declining stock prices, can lead to decreased demand for the currency, as investors seek to mitigate potential losses.

Bond Market

The bond market involves the trading of government and corporate debt. Interest rates, which play a crucial role in the bond market, have a direct impact on currency exchange rates. When interest rates rise in a country, it can attract foreign investors seeking higher returns on their investments. This increased demand for the country’s currency can lead to its appreciation. Conversely, when interest rates fall, it can reduce the attractiveness of the currency for foreign investors, potentially leading to its depreciation.

Government Policies: Suppose The Foreign Exchange Market Is In Equilibrium. Which Of The Following Statements Are Correct

Government policies play a crucial role in shaping the dynamics of the foreign exchange market. Tariffs, trade agreements, and other economic policies can significantly influence the supply and demand for currencies, thereby affecting the equilibrium exchange rate.

Tariffs

Tariffs are taxes imposed on imported goods, making them more expensive for consumers in the importing country. By increasing the cost of imports, tariffs can reduce demand for the currency of the exporting country, leading to its depreciation. Conversely, tariffs can boost demand for the currency of the importing country, resulting in its appreciation.

Trade Agreements

Trade agreements, such as free trade agreements (FTAs), reduce or eliminate tariffs and other trade barriers between participating countries. This can increase trade flows and boost demand for the currencies of both the exporting and importing countries, potentially leading to exchange rate appreciation.

Forecasting the Exchange Rate

Forecasting the exchange rate is a challenging task due to the numerous factors that influence it, including economic, political, and psychological elements. Despite these challenges, various methods are employed to predict future exchange rate movements.

Econometric Models

Econometric models utilize statistical techniques to analyze historical data and identify patterns that can be used to forecast future exchange rates. These models typically consider a range of economic variables, such as interest rates, inflation, and trade flows.

Technical Analysis

Technical analysis focuses on the historical price movements of a currency pair to identify trends and patterns that can be used to predict future movements. Technical analysts use charts and indicators to identify support and resistance levels, as well as potential reversal points.

Market Sentiment

Market sentiment plays a significant role in exchange rate fluctuations. Positive sentiment towards a particular currency can lead to increased demand and a stronger exchange rate, while negative sentiment can have the opposite effect. Market sentiment can be gauged through surveys, news headlines, and social media analysis.

Closing Notes

In conclusion, the equilibrium of the foreign exchange market is a complex and ever-evolving state influenced by a multitude of factors. By comprehending the forces that shape this market, we gain valuable insights into the global economy and its impact on businesses and individuals. As the world becomes increasingly interconnected, the foreign exchange market will continue to play a vital role in facilitating international trade and investment.