In the realm of global finance, the example situation of foreign exchange market stands as a captivating subject, where currencies dance and economic forces collide. This intricate tapestry of market dynamics, trading strategies, and risk management invites us on an enlightening journey into the world of currency exchange.

The foreign exchange market, a decentralized and ever-evolving arena, serves as a vital conduit for international trade, investment, and financial stability. Within its bustling ecosystem, a diverse cast of participants, from central banks to multinational corporations and individual traders, navigate the ever-shifting currents of currency values.

Market Participants

The foreign exchange market is a global marketplace where currencies are traded. Participants in this market range from individuals to large financial institutions.

Institutional traders include banks, investment funds, and hedge funds. They trade currencies for their clients or for their own account.

Finish your research with information from foreign exchange market definition business.

Individual traders, also known as retail traders, participate in the market on a smaller scale. They may trade currencies for profit or to hedge against currency risk.

Investigate the pros of accepting currency that dominates the foreign exchange market in your business strategies.

Central Banks, Example situation of foreign exchange market

Central banks are responsible for managing the monetary policy of their respective countries. They participate in the foreign exchange market to influence the value of their currencies.

Multinational Corporations

Multinational corporations operate in multiple countries and need to exchange currencies to conduct business. They participate in the foreign exchange market to manage their currency risk.

Market Structure

The foreign exchange market, unlike traditional financial markets, is decentralized, meaning it does not operate from a central physical location. This unique characteristic grants traders the freedom to engage in currency exchange transactions from anywhere globally.

At the core of the foreign exchange market lies the interbank market, a network of banks and financial institutions that facilitate currency exchange. These institutions act as market makers, quoting bid and ask prices for various currency pairs. When a trader places an order to buy or sell a currency, the interbank market matches them with a counterparty willing to execute the trade at the quoted price.

Electronic Trading Platforms

The advent of electronic trading platforms has revolutionized the foreign exchange market, enhancing its efficiency and accessibility. These platforms, such as EBS and Refinitiv, provide traders with a centralized marketplace where they can view live quotes, place orders, and execute trades in real-time. The increased transparency and reduced transaction costs offered by electronic trading platforms have contributed significantly to the growth and liquidity of the foreign exchange market.

Currency Pairs and Exchange Rates

In the foreign exchange market, currency pairs are the fundamental units of trade. They represent the exchange rate between two currencies, indicating how much of one currency is worth in terms of another. Currency pairs are crucial because they facilitate international trade, investment, and tourism.

Find out further about the benefits of foreign exchange market today in nigeria that can provide significant benefits.

Exchange rates are the prices at which currencies are traded against each other. They are determined by a complex interplay of economic factors, including supply and demand, interest rates, inflation, political stability, and global economic conditions. Exchange rates can fluctuate significantly over time, impacting the cost of goods and services traded internationally.

Major Currency Pairs

The most actively traded currency pairs in the foreign exchange market are known as major pairs. They include:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- USD/CAD (US Dollar/Canadian Dollar)

These major pairs account for a significant portion of global foreign exchange transactions and serve as benchmarks for other currency pairs.

Historical Exchange Rate Trends

Historical exchange rate trends can provide insights into the factors that influence currency fluctuations. For example, the value of the US dollar has generally strengthened against most major currencies over the past few decades, due to factors such as the strength of the US economy and its role as a global reserve currency.

Market Dynamics: Example Situation Of Foreign Exchange Market

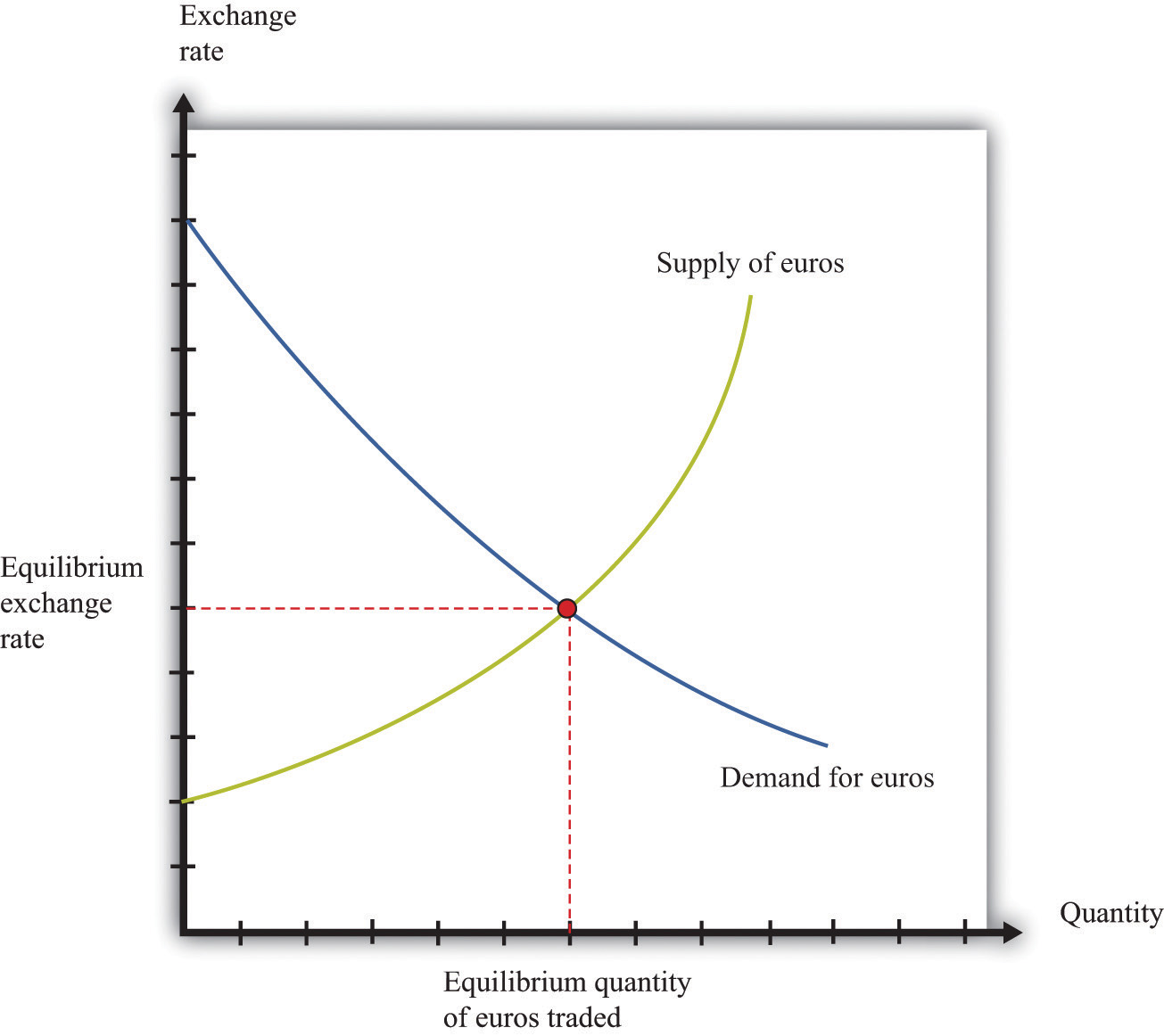

The foreign exchange market is a dynamic and ever-changing environment, where supply and demand play a crucial role in determining exchange rates. Supply and demand for currencies are influenced by a complex interplay of economic conditions, political events, and central bank policies.

Factors Affecting Currency Supply and Demand

The supply and demand for a currency are influenced by various factors, including:

- Economic conditions: Economic growth, inflation, and interest rates are key economic indicators that affect the demand for a currency. A strong economy typically attracts foreign investment, increasing demand for the currency and leading to appreciation.

- Political events: Political stability and uncertainty can significantly impact currency demand. Political instability or events that raise concerns about the economic or political outlook can lead to a decrease in demand for a currency, resulting in depreciation.

- Central bank policies: Central banks play a crucial role in managing the supply and demand for currencies through monetary policy tools, such as interest rate adjustments and quantitative easing. Changes in interest rates can influence the attractiveness of a currency for investment and affect its exchange rate.

Impact of Macroeconomic Factors on Exchange Rate Movements

Macroeconomic factors, such as economic growth, inflation, and interest rates, have a significant impact on exchange rate movements. These factors influence the relative attractiveness of different currencies for investment and trade, leading to changes in supply and demand and ultimately affecting exchange rates.

- Economic growth: Strong economic growth in a country typically leads to increased demand for its currency, as foreign investors seek to capitalize on the growth opportunities. This can result in currency appreciation.

- Inflation: Higher inflation rates can erode the value of a currency, making it less attractive for investment and leading to depreciation. Conversely, low inflation can enhance a currency’s stability and attractiveness.

- Interest rates: Higher interest rates make a currency more attractive for investment, as investors seek higher returns. This can lead to increased demand for the currency and result in appreciation.

Trading Strategies and Techniques

The foreign exchange market presents a wide array of trading strategies, each tailored to specific market conditions and individual risk appetites. Traders employ both technical and fundamental analysis to make informed decisions, leveraging a range of indicators and chart patterns to identify potential trading opportunities.

Technical analysis focuses on historical price data, using patterns and trends to predict future price movements. Popular technical indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). Chart patterns, such as head and shoulders or double tops, also provide valuable insights into potential price reversals or continuations.

Fundamental Analysis

Fundamental analysis, on the other hand, examines economic and political factors that influence currency values. These factors include interest rates, inflation, economic growth, and political stability. By understanding the underlying fundamentals that drive currency movements, traders can make more informed decisions about potential trades.

Risk Management

Engaging in foreign exchange trading involves inherent risks that traders must carefully consider and manage. Understanding the potential risks and implementing effective risk management strategies is crucial for protecting capital and ensuring long-term success in the forex market.

Risk management in forex trading encompasses various techniques aimed at minimizing potential losses while maximizing potential profits. It involves identifying, assessing, and mitigating risks associated with currency fluctuations, market volatility, and trading decisions.

Risk Mitigation Techniques

Traders employ a range of risk mitigation techniques to manage their exposure to forex market risks. These techniques include:

- Stop-Loss Orders:

These orders are placed to automatically close a trade when the price reaches a predetermined level, limiting potential losses in adverse market conditions. - Position Sizing:

Traders carefully determine the size of their positions relative to their account balance and risk tolerance. This helps prevent excessive exposure and potential catastrophic losses. - Hedging Strategies:

Traders may use hedging strategies to reduce risk by taking offsetting positions in different currency pairs or using financial instruments like options or futures.

Final Summary

As we conclude our exploration of the example situation of foreign exchange market, it is evident that this dynamic and interconnected realm plays a pivotal role in shaping global economic landscapes. Understanding its intricacies empowers us to navigate the complexities of currency exchange, mitigate risks, and capitalize on market opportunities.