The deregulation of foreign exchange market is an example of – Delving into the topic of deregulation of foreign exchange markets, we embark on an exploration of how this policy shift has reshaped the global financial landscape. The deregulation of foreign exchange markets has emerged as a prominent example of how governments can foster economic growth and stability through market liberalization.

By removing or reducing regulatory barriers in the foreign exchange market, countries have witnessed increased market efficiency, enhanced liquidity, and a more competitive environment for businesses and investors. This introduction sets the stage for a comprehensive examination of the benefits, risks, and policy considerations associated with the deregulation of foreign exchange markets.

Historical Context of Foreign Exchange Market Regulation: The Deregulation Of Foreign Exchange Market Is An Example Of

The foreign exchange (forex) market has undergone significant regulatory evolution over time, driven by economic, political, and technological factors. Early regulations aimed to control currency exchange rates and protect national economies, while later reforms focused on promoting market stability and facilitating cross-border transactions.

One of the earliest forms of forex regulation was the gold standard, which pegged national currencies to the value of gold. This system helped stabilize exchange rates and facilitated international trade. However, the gold standard was abandoned in the early 20th century due to the outbreak of World War I and the subsequent economic turmoil.

Bretton Woods System

After World War II, the Bretton Woods System was established to create a more stable international monetary order. Under this system, currencies were pegged to the US dollar, which was in turn backed by gold. The Bretton Woods System helped promote global economic growth and stability for several decades.

Floating Exchange Rates

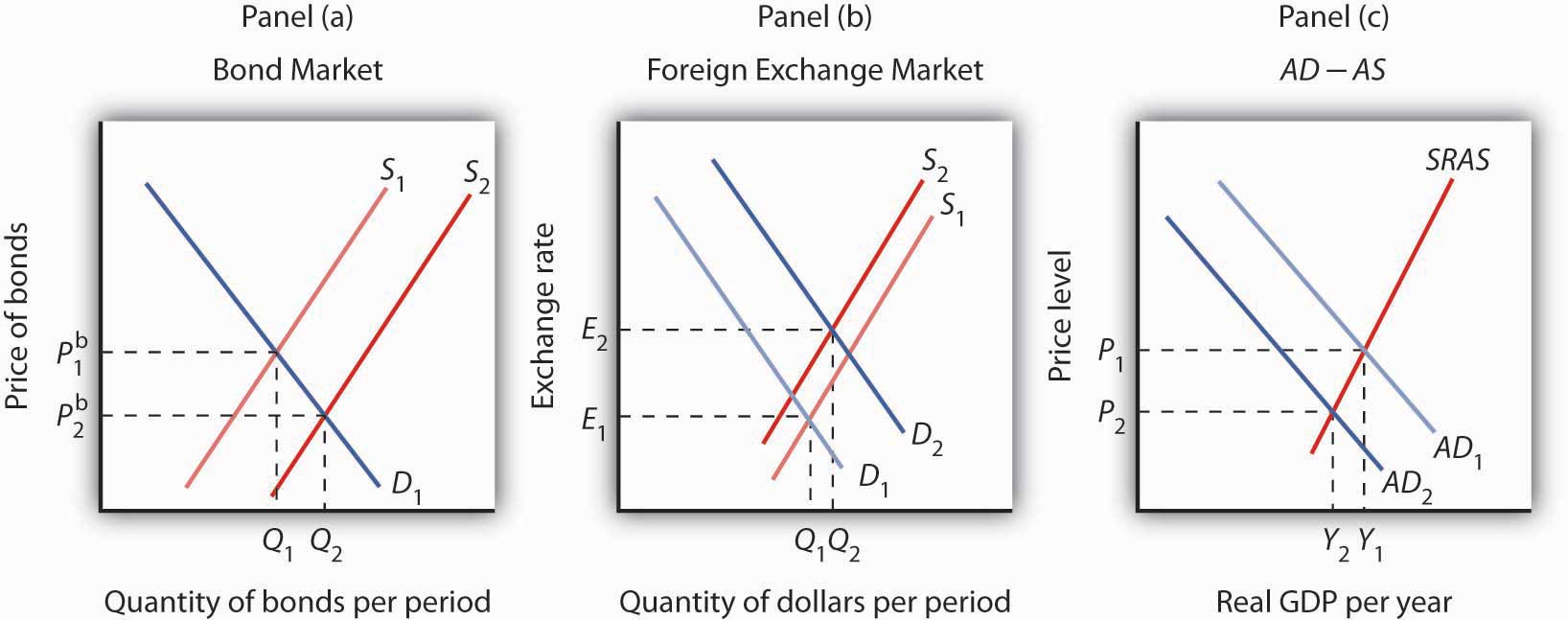

In the early 1970s, the Bretton Woods System collapsed, and most major currencies adopted floating exchange rates. Under a floating exchange rate system, the value of a currency is determined by supply and demand in the forex market. This system has allowed for greater flexibility and resilience in the global economy.

Modern Forex Regulation

In recent decades, forex regulation has focused on promoting market stability and protecting investors. Key regulations include:

- Basel Accords: International banking regulations that set capital adequacy requirements for banks involved in forex trading.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: US legislation that regulates the forex market and enhances consumer protection.

- MiFID II: European Union legislation that regulates financial markets, including the forex market.

These regulations have helped to improve the transparency, efficiency, and integrity of the forex market.

Benefits of Deregulating the Foreign Exchange Market

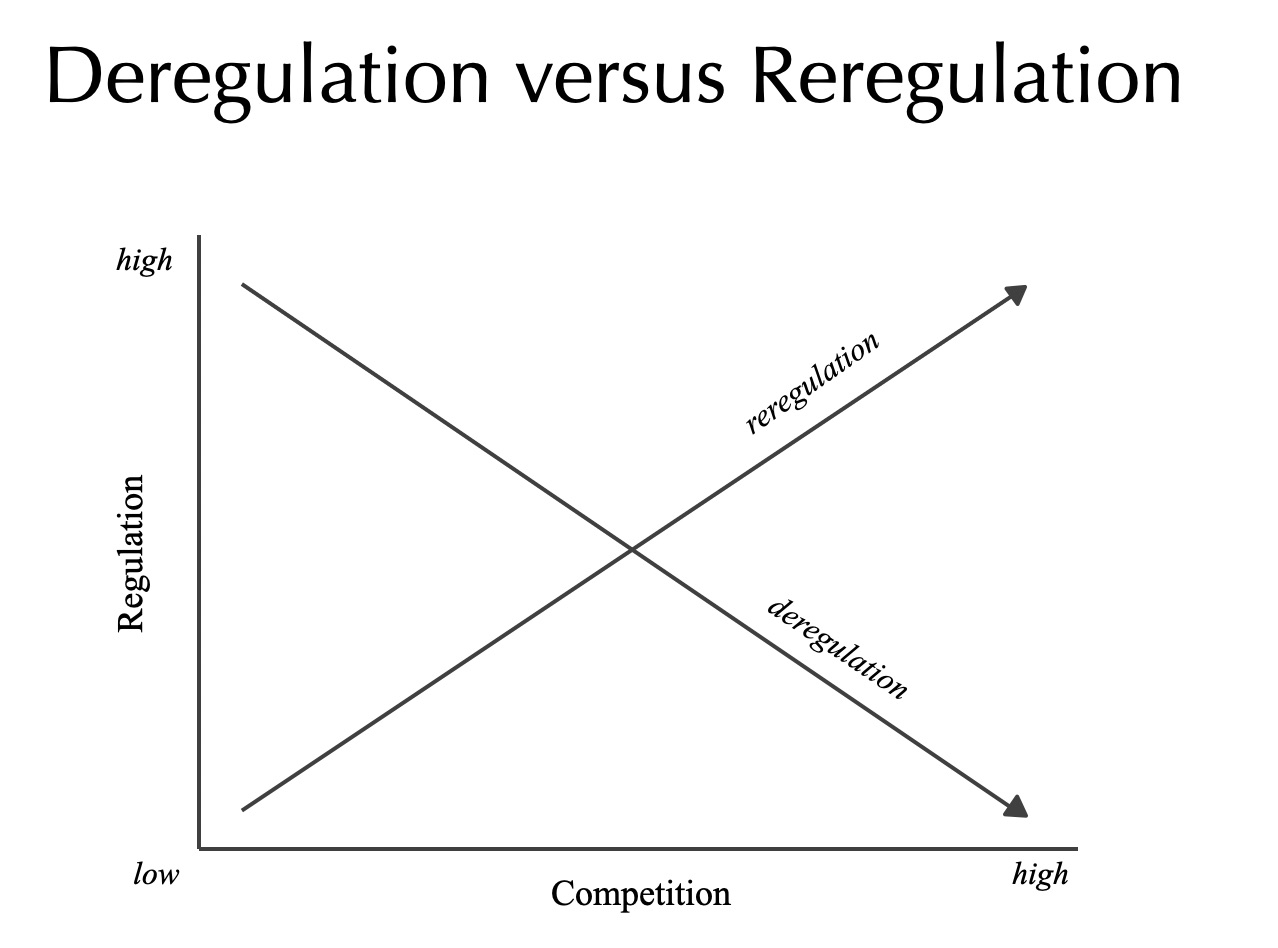

Deregulating the foreign exchange market brings about numerous benefits that enhance market efficiency, liquidity, and overall economic growth.

By removing government-imposed restrictions and barriers to entry, deregulation allows for increased competition and participation in the market. This leads to lower transaction costs, faster execution times, and a wider range of products and services available to market participants.

Expand your understanding about foreign exchange market disadvantages with the sources we offer.

Enhanced Market Efficiency, The deregulation of foreign exchange market is an example of

Deregulation promotes market efficiency by allowing the forces of supply and demand to operate more freely. Market participants can respond quickly to changing economic conditions, leading to more accurate and efficient price discovery. This reduces information asymmetries and improves the allocation of capital across borders.

- In deregulated markets, participants can access a wider pool of liquidity, enabling them to execute large transactions quickly and at competitive prices.

- The removal of restrictions on foreign exchange trading hours extends market access and allows for continuous trading, further enhancing liquidity and market efficiency.

Increased Liquidity

Deregulation increases liquidity in the foreign exchange market by attracting new participants, such as hedge funds, proprietary trading firms, and retail investors. This increased participation leads to a larger pool of buyers and sellers, which in turn improves market depth and reduces bid-ask spreads.

Find out further about the benefits of foreign exchange market pictures that can provide significant benefits.

- Deregulated markets have experienced significant growth in trading volumes, demonstrating the increased liquidity and accessibility brought about by deregulation.

- The entry of new participants, such as high-frequency traders, has contributed to the increased liquidity and efficiency of the foreign exchange market.

Potential Risks and Challenges of Deregulation

While deregulation of the foreign exchange market can bring potential benefits, it also comes with certain risks and challenges that need to be considered.

One of the main concerns is the potential for increased volatility in the exchange rate. When the market is deregulated, there is less government intervention to stabilize the currency, which can lead to sharp fluctuations in its value. This volatility can make it more difficult for businesses to plan their operations and can lead to uncertainty in the economy.

Systemic Instability

Another risk associated with deregulation is the potential for systemic instability. In a deregulated market, there is less oversight and regulation of financial institutions, which can increase the risk of financial crises. For example, the deregulation of the financial industry in the United States in the 1990s is widely believed to have contributed to the 2008 financial crisis.

Investigate the pros of accepting meaning and definition of foreign exchange market in your business strategies.

Policy Considerations for Deregulation

Governments considering the deregulation of their foreign exchange markets must carefully weigh the potential benefits and risks involved. Key policy considerations include:

Regulatory Oversight and Market Surveillance

Deregulation does not imply a complete absence of government oversight. Governments must establish a framework for ongoing regulatory oversight and market surveillance to ensure:

- Market stability and integrity

- Prevention of market manipulation and abuse

- Protection of market participants

li>Compliance with anti-money laundering and terrorist financing regulations

This framework should include mechanisms for:

- Monitoring market activity

- Enforcing regulations

- Imposing penalties for non-compliance

Case Studies of Deregulated Foreign Exchange Markets

Several countries have successfully deregulated their foreign exchange markets, leading to increased market efficiency, reduced transaction costs, and enhanced economic growth. These case studies provide valuable insights into the factors that contribute to successful deregulation and the lessons that can be learned from their experiences.

Chile

Chile’s deregulation of its foreign exchange market in 1991 was a significant milestone in its economic development. The liberalization measures included the elimination of foreign exchange controls, the introduction of a floating exchange rate system, and the removal of restrictions on capital inflows and outflows. These reforms led to increased foreign investment, reduced inflation, and improved economic growth.

Key factors contributing to Chile’s success included:

- Gradual and well-sequenced implementation of reforms

- Strong macroeconomic fundamentals and a stable political environment

- Effective monetary policy and financial regulation

Singapore

Singapore has been a leader in foreign exchange market deregulation since the 1970s. The country’s open and transparent regulatory framework has attracted a large number of foreign banks and financial institutions, making Singapore a major international financial center.

Key factors contributing to Singapore’s success included:

- A stable political and economic environment

- Sound monetary policy and financial regulation

- A highly skilled and educated workforce

Lessons Learned

The case studies of Chile and Singapore provide valuable lessons for countries considering foreign exchange market deregulation:

- Deregulation should be implemented gradually and in a well-sequenced manner to minimize risks.

- Strong macroeconomic fundamentals and a stable political environment are essential for successful deregulation.

- Effective monetary policy and financial regulation are crucial to maintain stability and prevent excessive volatility in the foreign exchange market.

Emerging Trends and Future Prospects

The foreign exchange market is constantly evolving, and deregulation is one of the most significant trends shaping its future. As technology advances and cross-border cooperation increases, we can expect to see even more deregulation in the years to come.

Technology

Technology is playing a major role in the deregulation of the foreign exchange market. The development of electronic trading platforms has made it easier for traders to access the market and execute trades. This has increased competition and reduced the cost of trading, making it more difficult for regulators to justify intervention.

Cross-border cooperation

Cross-border cooperation is another important trend that is driving deregulation. As countries become more interconnected, it is becoming increasingly difficult to regulate the foreign exchange market on a national level. This is leading to a trend towards global regulation, which is likely to be less restrictive than national regulation.

Future prospects

The future of deregulation in the foreign exchange market is uncertain. However, it is likely that we will see even more deregulation in the years to come. This will have a number of implications for the global economy, including increased volatility and risk, as well as greater opportunities for growth.

Final Wrap-Up

In conclusion, the deregulation of foreign exchange markets has proven to be a multifaceted policy tool with the potential to unlock economic growth and foster financial stability. While not without its challenges, the lessons learned from successful deregulation efforts can guide policymakers as they navigate the complex landscape of international finance.

As the global economy continues to evolve, the deregulation of foreign exchange markets will undoubtedly remain a topic of significant interest and debate. By embracing a balanced approach that considers both the opportunities and risks involved, policymakers can harness the power of deregulation to create more dynamic and resilient financial markets.