Real world example of foreign exchange market, a vast and ever-evolving arena, presents a compelling microcosm of global economic forces. From currency fluctuations that impact international trade to technological advancements that transform trading strategies, this dynamic marketplace offers a wealth of insights into the interconnectedness of our world.

Delving into the intricacies of the forex market, we uncover the key players, unravel the factors that influence exchange rates, and explore the diverse methods of trading employed by market participants. By examining real-world events and case studies, we gain a tangible understanding of the market’s impact on businesses, economies, and individuals alike.

Understanding the Real World Example of Foreign Exchange Market

The foreign exchange market, also known as forex, is the global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

The key players in the forex market include banks, investment firms, hedge funds, and retail traders. Banks are the largest participants in the market, accounting for over 50% of all trading volume. Investment firms and hedge funds are also major players, and retail traders account for a small but growing share of the market.

Factors Influencing Currency Exchange Rates

The value of a currency is determined by a number of factors, including:

- Economic growth: Countries with strong economic growth tend to have stronger currencies.

- Inflation: Inflation can erode the value of a currency over time.

- Interest rates: Higher interest rates can attract foreign investment and strengthen a currency.

- Political stability: Political instability can weaken a currency.

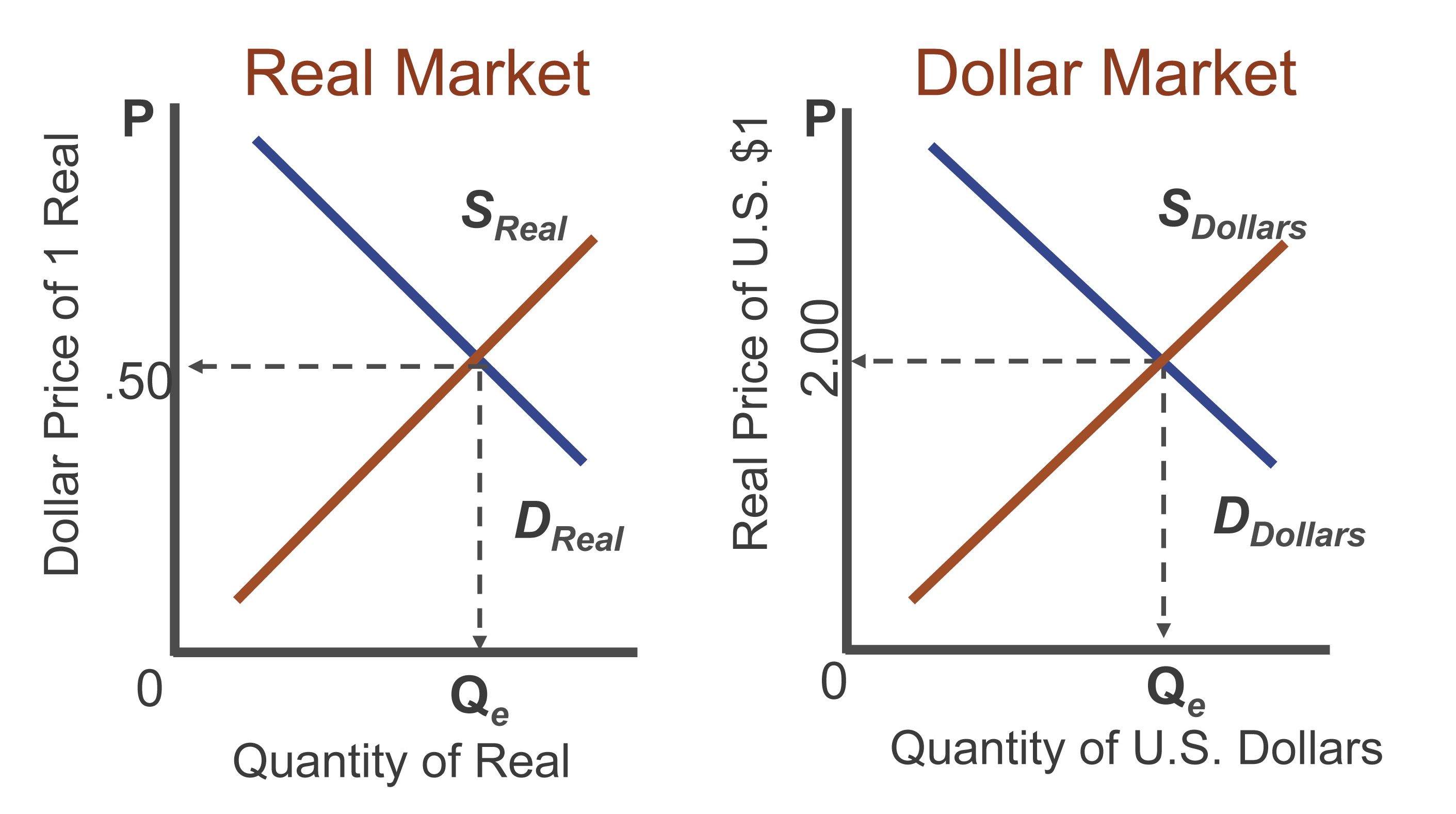

- Supply and demand: The supply and demand for a currency can also affect its value.

Methods of Trading in the Foreign Exchange Market

Traders in the foreign exchange market employ various methods to execute their trades. Each method offers unique advantages and drawbacks, catering to different trading styles and risk appetites. Understanding these methods is crucial for traders to choose the most suitable approach based on their individual needs and preferences.

Over-the-Counter (OTC) Trading

- OTC trading occurs directly between two parties without involving a centralized exchange.

- It offers greater flexibility and customization, allowing traders to negotiate terms such as trade size, price, and settlement date.

- However, OTC trading can be less transparent and more susceptible to counterparty risk compared to exchange-traded markets.

Exchange-Traded Trading

- Exchange-traded trading involves buying and selling currencies through regulated exchanges, such as the Chicago Mercantile Exchange (CME) or the London Stock Exchange (LSE).

- It provides standardized contracts, ensuring transparency and reducing counterparty risk.

- However, exchange-traded trading may offer less flexibility and may not cater to all currency pairs or trade sizes.

Electronic Communication Networks (ECNs)

- ECNs are electronic platforms that connect multiple participants in the foreign exchange market.

- They provide real-time quotes and facilitate anonymous trading, offering greater efficiency and reduced transaction costs.

- However, ECNs may have limited liquidity for certain currency pairs or during periods of high market volatility.

Choosing the Most Suitable Trading Method, Real world example of foreign exchange market

The choice of trading method depends on several factors, including trading style, risk tolerance, and available capital. Traders who prioritize flexibility and customization may prefer OTC trading. Those seeking transparency and reduced counterparty risk may opt for exchange-traded trading. ECNs offer a balance between efficiency and liquidity, making them suitable for high-frequency traders. Ultimately, traders should carefully consider their individual needs and select the trading method that best aligns with their objectives.

Impact of the Foreign Exchange Market on the Global Economy

The foreign exchange (forex) market plays a pivotal role in facilitating global trade and investment. It enables businesses and individuals to exchange currencies and make cross-border transactions efficiently. The fluctuations in currency values have significant implications for international businesses, affecting their profitability, competitiveness, and investment decisions.

Impact on Global Trade

Currency fluctuations directly impact the cost of imported and exported goods. When a country’s currency depreciates, its exports become cheaper in foreign markets, making them more competitive and increasing export revenue. Conversely, a currency appreciation makes imports more expensive, potentially leading to reduced demand and lower import volumes.

For example, in 2016, the depreciation of the Chinese yuan against the US dollar made Chinese exports more affordable for US consumers, boosting Chinese export revenue. Conversely, the appreciation of the Japanese yen against the US dollar in 2017 made Japanese imports more expensive in the US, leading to a decline in import volumes.

Impact on Foreign Direct Investment (FDI)

Currency fluctuations also influence foreign direct investment (FDI) decisions. Investors tend to prefer investing in countries with stable or appreciating currencies as it reduces the risk of currency losses on their investments. Conversely, currency depreciation can deter foreign investment as it reduces the value of returns when converted back to the investor’s home currency.

For instance, the appreciation of the Brazilian real against the US dollar in 2007 attracted foreign investment into Brazil, seeking to capitalize on the country’s economic growth and currency appreciation. In contrast, the depreciation of the Russian ruble against the US dollar in 2014 deterred foreign investment, as investors feared currency losses on their investments.

Impact on Global Economic Growth

Currency fluctuations can have ripple effects on global economic growth. A sharp depreciation in a major currency can trigger currency devaluations in other countries, leading to a loss of confidence in the global financial system. This can result in reduced investment, trade, and economic growth.

For example, the Asian financial crisis in 1997-98, triggered by the devaluation of the Thai baht, led to currency devaluations and economic downturns in several Southeast Asian countries, negatively impacting global economic growth.

Using Technology in the Foreign Exchange Market

Technology plays a pivotal role in the foreign exchange market, transforming trading strategies, risk management, and the overall landscape for traders. Advanced technological advancements have revolutionized the way currencies are traded, bringing unprecedented speed, efficiency, and accessibility to the market.

Role of Technology in the Foreign Exchange Market

Technology has empowered traders with sophisticated tools and platforms that enable real-time market monitoring, automated order execution, and in-depth analysis. The widespread adoption of electronic trading platforms has eliminated geographical barriers and created a global marketplace where traders can connect and execute trades instantly.

Impact on Trading Strategies and Risk Management

Technology has significantly influenced trading strategies. Algorithmic trading, powered by artificial intelligence (AI) and machine learning, allows traders to execute complex strategies with precision and speed. These algorithms analyze market data, identify trading opportunities, and automatically place trades based on predefined parameters, reducing human error and enhancing efficiency.

Technology has also revolutionized risk management practices. Advanced risk management tools enable traders to monitor their positions in real-time, set stop-loss orders to limit potential losses, and hedge their exposures to currency fluctuations. This enhanced risk management capability has increased trader confidence and reduced the overall risk associated with foreign exchange trading.

Enhance your insight with the methods and methods of in the foreign exchange market a decrease in the world demand for japanese exports.

Latest Technological Advancements and Their Impact on Traders

The foreign exchange market is constantly evolving, with new technological advancements emerging regularly. Some of the latest innovations include:

- Blockchain technology: Blockchain is a distributed ledger system that enables secure and transparent record-keeping. Its potential applications in the foreign exchange market include automating settlement processes, reducing transaction costs, and enhancing the overall efficiency of the market.

- Artificial intelligence (AI): AI-powered trading platforms offer advanced features such as predictive analytics, sentiment analysis, and automated trade execution. These tools help traders make informed decisions, identify market trends, and optimize their trading strategies.

- Cloud computing: Cloud computing provides traders with access to powerful computing resources and data storage capabilities. This allows them to run complex trading algorithms, analyze large datasets, and access real-time market information from anywhere with an internet connection.

These technological advancements are empowering traders with unprecedented capabilities, enabling them to trade more efficiently, manage risk more effectively, and stay ahead in the competitive foreign exchange market.

Strategies for Success in the Foreign Exchange Market

Success in the foreign exchange market requires a combination of knowledge, skill, and strategic planning. Here are some key strategies to help you succeed in the forex market:

1. Risk Management

Managing risk is crucial in forex trading. Determine your risk tolerance and develop a trading plan that aligns with it. Use stop-loss orders to limit potential losses and position sizing to control the amount of risk you take on each trade.

2. Trading Plan

A well-defined trading plan Artikels your trading strategy, risk management parameters, and entry and exit points. It helps you stay disciplined and avoid emotional decision-making during market fluctuations.

3. Technical Analysis

Find out further about the benefits of foreign exchange market meaning in economics that can provide significant benefits.

Technical analysis involves studying price charts and patterns to identify trading opportunities. By analyzing historical data, you can make informed predictions about future price movements.

4. Fundamental Analysis

Expand your understanding about the foreign exchange market serves two main functions. these are with the sources we offer.

Fundamental analysis focuses on economic and political factors that influence currency values. By understanding these factors, you can gain insights into market trends and make informed trading decisions.

5. Practice and Patience

Forex trading requires practice and patience. Start with a demo account to gain experience without risking real capital. Practice your trading strategies and refine them over time. Remember that success in forex trading is a gradual process.

Illustrating with Examples and Case Studies: Real World Example Of Foreign Exchange Market

Real-world examples and case studies provide valuable insights into the dynamics of the foreign exchange market. These illustrate the impact of currency fluctuations on businesses and economies, showcasing both successful and unsuccessful trades.

Successful Trades

- In 2017, a hedge fund manager predicted the depreciation of the British pound following Brexit. They sold GBP/USD futures, profiting from the subsequent decline in the pound’s value.

- In 2021, a retail trader correctly anticipated the rise of the US dollar against the Japanese yen. They bought USD/JPY currency pairs, generating significant returns as the dollar strengthened.

Unsuccessful Trades

- In 2015, the Swiss National Bank unexpectedly abandoned its peg of the Swiss franc to the euro. This led to a surge in the franc’s value, resulting in losses for traders who had bought EUR/CHF currency pairs.

- In 2018, a major investment bank made a large bet on the appreciation of the Turkish lira. However, the lira’s value plummeted due to political instability, causing the bank to suffer substantial losses.

Case Studies

| Case Study | Impact of Currency Fluctuations | Outcome |

|---|---|---|

| Multinational Corporation | Appreciation of home currency reduced the value of overseas earnings, impacting profitability. | Implementation of hedging strategies to mitigate currency risk. |

| Export-Oriented Business | Depreciation of local currency increased the cost of imported raw materials, eroding margins. | Re-negotiation of contracts with suppliers to adjust for currency fluctuations. |

| Emerging Market Economy | Currency crisis caused a sharp devaluation, leading to hyperinflation and economic instability. | International Monetary Fund intervention and implementation of austerity measures to stabilize the economy. |

Final Wrap-Up

In the ever-changing landscape of the foreign exchange market, understanding real-world examples is paramount for navigating its complexities and harnessing its potential. Through a comprehensive exploration of trading strategies, technological advancements, and global economic implications, this discourse provides a valuable roadmap for navigating the dynamic terrain of the forex market.